Too many Americans are unaware of the importance of investing early on in their lives, and the impact that early investing can have on your financial future.

I began to understand the importance of putting your money to work early in life during an economics class I took during my senior year of high school. Towards the end of the school year, when the vast majority of the course’s curriculum had been covered, my teacher took a day to teach the class a little about investing and compound returns.

She showed us a slide that demonstrated that if you invested you money wisely, and were able to achieve a decent return on that investment, then you had the ability to build more wealth by investing less money than if you were to stockpile even large amounts of cash and hide it under your mattress.

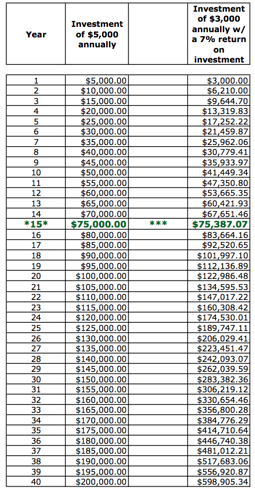

The chart looked similar to this. (The figures in bold, green font show that the account that invested $3,000 annually and achieved a 7% return surpassed the account that saved $5,000 annually after 15 years).

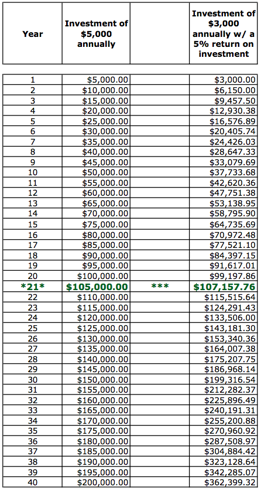

The next chart displays the effect that a 5% return would have on growth, as opposed to the 7% return showed above. (The figures in bold, green font show that the account that invested $3,000 annually and achieved a 5% return surpassed the account that saved $5,000 annually after 21 years).

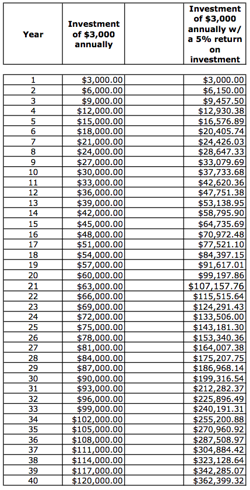

The third and final chart shown below demonstrates the potential for building wealth by showing side-by-side the differences between merely saving $3,000 each year and investing $3,000 each year and achieving a 5% annualized return. The result is more than three times the amount money at the end of a forty-year period for the investor as opposed to the saver.

Remember.

It is crucial to understand the importance of investing early for yourself or the family member that you are beginning the portfolio for. Recognize the fact that you are not trying to strike it rich on a single trade, understand that the most advantageous “investing” strategy for the long term is to focus on building positions over time. If you invest in mutual funds you will have the option of reinvesting both capital gains and dividends back into the fund; likewise, if you invest in dividend paying stocks you can choose to have your dividends reinvested into additional shares. Reinvesting dividends is typically more beneficial for long-term growth than receiving cash dividend payments.

For more tips on how to identify favorable investment opportunities, pick high quality stocks, and build a solid portfolio read some of the articles I have previously written including "Bolster Your Portfolio With Dividend Stocks" and "5 Indicators of a Great Investment Opportunity".

Also, for additional investing advice, stock picks, and financial news visit my blog Above The Noise and follow me on Twitter @ATN_Investing

No comments:

Post a Comment